Deep: New payment features and capabilities explored

How Stripe, Apple Pay, Affirm, PayPal, Klarna, Revolut, Square and more are innovating to drive revenues

🔒DoP Deep goes deeper into the concepts and ideas that are covered in the Weekly Briefing to help you learn lessons from the experiences of top tech companies. If you’d like to upgrade to receive these in-depth pieces of analysis you can do so below. Or you can find out more about what you get as a paid subscriber here.

Hi product people 👋,

In the briefing, we recently mentioned that PayPal is partnering with Adyen to offer its new payment checkout experience, Fastlane, to users in the US. As part of the announcement, PayPal confirmed that its new feature helped users convert by an impressive 80% of the time when compared to a traditional guest checkout.

With other payment providers like Stripe also releasing new features like Link which it says boost conversion rates by up to 7%, it goes without saying that understanding new payment features and capabilities can have a pretty dramatic impact on your product’s revenue performance.

In this deep dive, we’ll explore what new payment features and capabilities the world’s leading tech companies and payment providers are offering in 2024 so that you’re fully up to speed on everything that’s available for product teams to use when taking payments from users.

If you’re currently exploring how to optimize your payment capabilities, this should hopefully help give you some inspiration.

Coming up:

How this analysis is structured

Company deep dives - a closer look at some of the companies featured including Stripe, Google and Apple Pay, Affirm, PayPal, Klarna and more

How a new type of payment button could transform the payment experience

How one new AI-powered payment feature drove overall revenues up by 11.9%

Broader payment trends and predictions to be aware of

All of companies featured in this deep dive in full

How this deep dive is structured

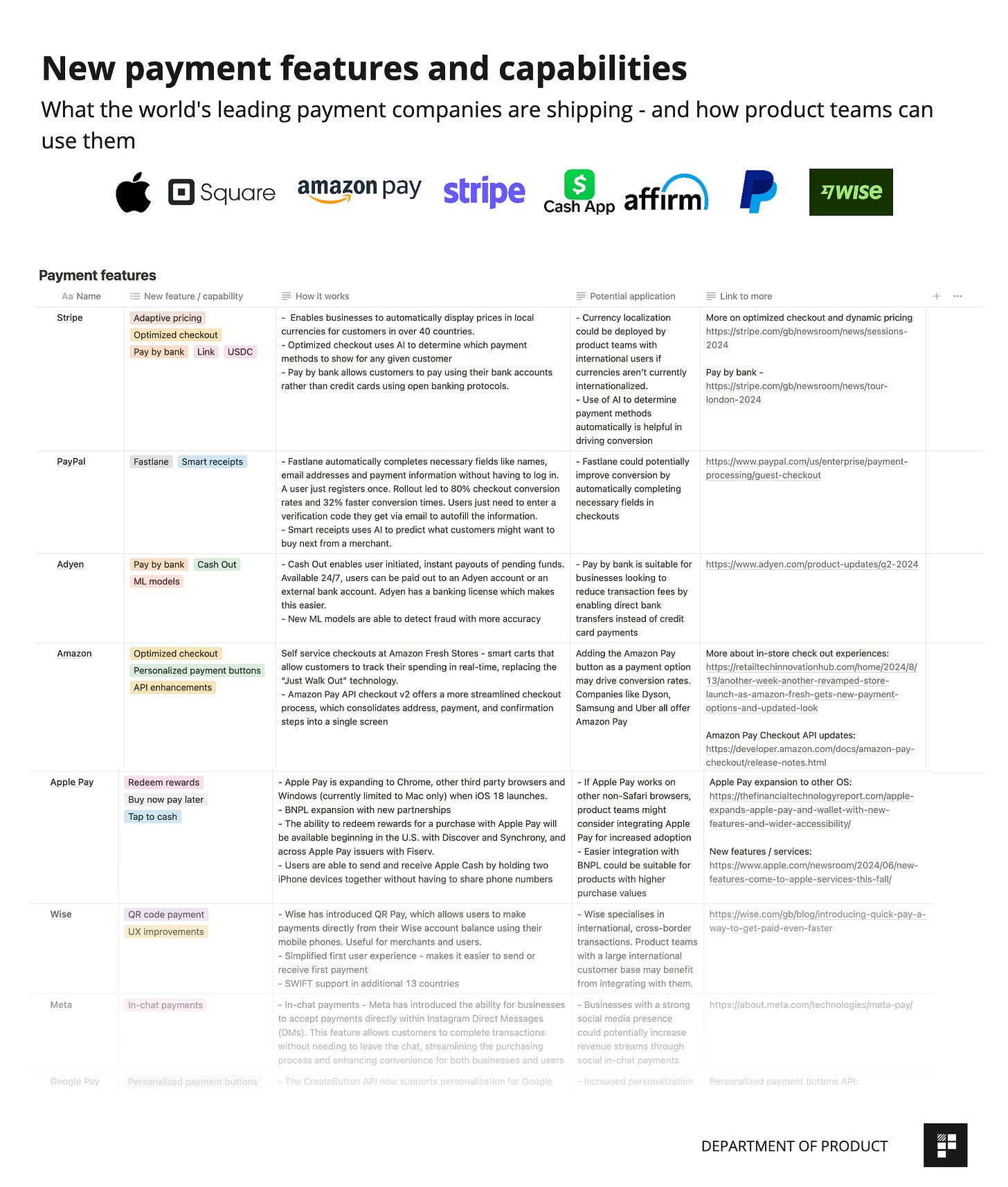

This analysis doesn’t include every single feature that a payment company offers as that would clearly be a little overwhelming. Instead, it focuses on notable new features and capabilities that have recently been rolled out and how product teams might be able to use them so that you’re up to speed with new capabilities on offer to product teams.

Company - the payment company featured

New payment feature / capability - what is the new payment feature or capability that’s been released?

How it works - how does this new payment feature work? Detailed explanation on how it works, relevant technologies used and any other useful information about the feature.

Potential application example - how could the payment feature be used by product teams? Ideas on how this payment feature / capability could be applied by product teams and why it might be valuable.

Link to more information - more information about each of the payment features and capabilities.

This analysis includes a variety of different payment features and capabilities which span not consumer facing features and new API functionality, too. There are over 20 different types of new features included in this analysis and this includes:

Pay by bank and other new payment capabilities - pay by bank is a new capability that is gradually being offered by more payment companies which allows users to bypass the credit card networks and initiate a payment using a bank transfer. We’ll look at how companies like Stripe and Google Pay do this, along with other new payment methods.

API enhancements - payment providers are always adding new payment capabilities. From new GraphQL APIs to new endpoints, we’ve filtered through some of the most important ones that have recently been added to companies like Amazon, Google, CashApp, Square and more.

Smart receipts - these are becoming increasingly popular. Smart receipts add extra capabilities to receipts which can potentially drive return purchases. Some payment providers are offering businesses the chance to add additional information into receipts which can help manage returns or integrate with third party software to manage expenses.

Optimized checkout features - new features specifically designed to help drive checkout conversion rates. This includes new biometric capabilities from Google Pay and Revolut, deployment of AI to dynamically show different payment methods and other new features which make entering payment details easier for both registered users and guests.

Machine learning models - used to detect fraud and intervene when a payment provider believes a transaction is fraudulent. Some fintech companies say that many of these efforts have reduced fraudulent transactions by 30% and we’ll take a look at some examples of how ML models are improving the overall payment experience.

UX improvements - payment companies are taking big steps to improve the user experience for making payments. This deep dive includes examples from Square who simplified their onboarding process, Wise who implemented changes to make it easier to receive a first payment and others.

If you’re currently exploring adding new payment features or functionality, this should help guide your thinking.

Company deep dives - a closer look at payment companies including Google Pay, Apple, Stripe, Affirm and others

Google and Apple Pay

Along with PayPal, Google and Apple Pay are two of the world’s most popular payment wallet companies. In the US market, PayPal, Google and Apple make up the top 3 most popular wallet providers and so when Google and Apple Pay introduce new feature and capabilities, it inevitably has a ripple effect on the rest of the market.

Looking at Google Pay first, the company recently rolled out a series of API improvements which are potentially transformative for product teams looking to boost conversion.