Why did Stripe spend $1.1bn on a Stablecoin startup?

Key takeaways for product teams and the future of payments

🔒DoP Deep goes deeper into the concepts and ideas that are covered in the Weekly Briefing to help you learn lessons from the experiences of top tech companies. Paid subscribers get ongoing access to new reports every month.

Hi everyone 👋,

In the briefing we mentioned that Stripe has recently acquired stablecoin business, Bridge, for a rather significant $1.1 billion.

But beyond the headlines, this acquisition could be transformative for the payment choices and capabilities that product teams / tech companies offer to their users. But, as a new Pew poll1 shows, the US is far from sold on cryptocurrencies with 63% of respondents saying they don’t trust it.

In this Deep dive, we’ll explore what stablecoins are and more importantly - what Stripe’s acquisition could mean for product teams and the payment industry so that if your product eventually decides to support stablecoins, you’re fully up to speed with what they are.

Coming up:

What exactly is a stablecoin? A simple explanation

Why Stripe has acquired Bridge - some strategic considerations

Why product teams should care about stablecoins: scenarios explored from the perspective of B2B SaaS, ecommerce and B2C products

Use cases and opportunities for stablecoins by product teams

What exactly is a stablecoin anyway? A simple explanation

I first came across the concept of stablecoins back in 2020 when we were locked down during the pandemic and many people had very little else to do except work remotely and cryptocurrencies were surging.

I’ll admit it: I bought some Dogecoin and a few other cryptos without really knowing what I was doing. It was only after losing most of what I invested that I figured I should really try to understand more about the cryptocurrency markets and how it works (or doesn’t). So that’s what I did - and after chatting to a friend who works in the crypto industry, ultimately I decided not to invest a penny more into that asset class for the time being.

But that’s enough about my brief flirtation with the crypto markets. Back to stablecoins - and why stablecoins might offer a glimmer of hope for crypto enthusiasts.

A stablecoin is a type of cryptocurrency designed to maintain a stable value relative to a reference asset, typically a fiat currency like the US dollar. In this sense, stablecoins are different to other cryptocurrencies because they’re far less volatile.

The two key characteristics of stablecoins are:

First, stability. Stablecoins are described as stable for a reason - and they aim to minimize price volatility compared to other cryptocurrencies.

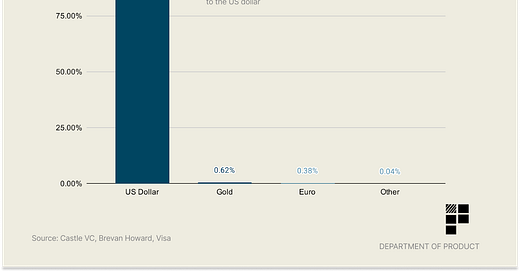

Second, they’re pegged to an asset. A stablecoin can be pegged to any number of different assets but by far the most popular asset for stablecoins to be pegged to is the US dollar:

Being pegged to an asset means that a stablecoin aims to maintain a fixed exchange rate with that asset, typically at a 1:1 ratio. For example, a stablecoin pegged to the US dollar aims to always be worth $1.

Stablecoins also maintain their stability by keeping a reserve of traditional currencies as collateral. Collateralization refers to the method of backing a stablecoin with reserve assets to support its value. For every stablecoin in circulation, there should be an equivalent amount of assets in reserve.

How are stablecoins different from other cryptocurrencies?

Compared to other cryptos, stablecoins have little to do with price. By their very nature, they're meant to be stable, and there are now stablecoins that have established themselves. Paxos PUSD, Circle's USDC, and even the often-questioned Tether have maintained their peg to the US Dollar but others (like Terra Luna), lost their entire market cap when panicked investors sold all of their assets at the same time.

Today, the world’s most popular stablecoin is USDT (Tether) which accounts for approximately 70% of the total stablecoin market. As of June 2024, USDT has reserves amounting to $118,436,336,293 USD. Other stablecoins include USDC, DAI and Ethena.

Here’s a quick overview of how stablecoins are different to traditional currencies:

Why Stripe has acquired Bridge

Now that we know a little more about the basic fundamentals of stablecoins and what they are, let’s explore some of the reasons why Stripe has acquired Bridge - a stablecoin business - and what this could mean for product teams.